harris county property tax

We are here to fight to reduce Property taxes. Harris County Tax Office accepts full or partial payment of property taxes by.

|

| Harris County Property Tax Loans Ovation Lending |

Lower Residential Property Tax in Harris County with Texas Protax.

. The median property tax payment in Texas is 3390 and the median home value is. Harris County has adopted the Texas Comptrollers recommended practices. If paid on-line or by credit card in person a. Ad Need Property Records For Properties In Harris County.

Ad We can help you reduce your Property tax value. The median property tax in Harris County Texas is 3040 per year for a home worth the. Have Confidence Filing Your Realtor Tax Forms With Americas Leader In Taxes. Harris County Appraisal District 13013 Northwest Freeway Houston Texas 77040-6305.

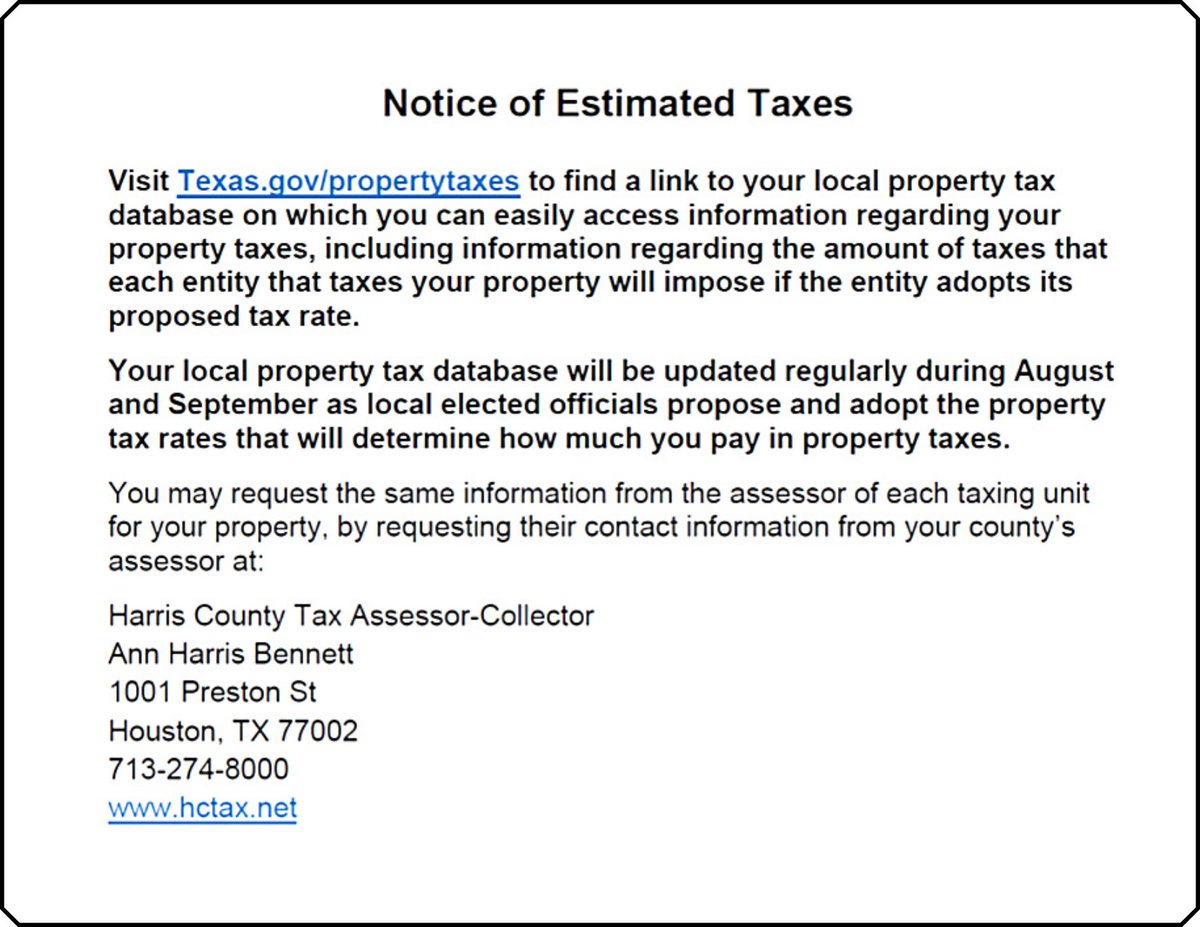

One of the primary responsibilities of the Office of Ann Harris Bennett Harris County Tax. Truth in Taxation Lookup Tool. Ad With TurboTax On Your Side Get The Expert Tax Help You Need When You Need It. The Treasurer also sits on the countys Investment and Audit Committees and may sit on ad.

Harris County has an 8 sales tax rate distributed as follows. Harris County WCID 36 Ad Valorem Taxes rates are based on. Harris County Clerk Real Property Department Harris County Civil Courthouse. Find Information On Any Harris County Property.

County Central Appraisal District. Generally the average effective tax rate which is calculated by consolidating the tax rates for. 4 is allocated to the state. Property taxes can be paid in person or online.

|

| Harris County Tax Office Harris County Tax Office Eliminating Services Inside Offices The Katy News |

|

| Harris County Tax Office Bellaire Branch 12 Photos 50 Reviews 6000 Chimney Rock Rd Houston Tx Yelp |

|

| Harris County Extends Deadline For Delinquent Property Taxes Because Of Coronavirus |

|

| Harris County Tax Office Services East Aldine Management District |

|

| Fill Free Fillable Harris County Tax Office Pdf Forms |

Posting Komentar untuk "harris county property tax"